In my time at CW the value on invoices to declare exportvalue was manipulated (devaluated) on a large scale.

When asking for the reason it was said to pay less tax.

I have always had my doubts if this is the real and only reason, but it is surely fraude in China.

The effect on European economy is that not enough import tax is payed, which on its turn results in false competition with local suppliers. Here some proof and backgrounds:

NOT ENOUGH IMPORT TAX IS COLLECTED

The amount of direct evidence is limited since the devaluated invoices are not registered and only send with the goods to the final destinations.

Many clients do not even know invoices are devaluated since production and finance are separate departments.

Some clients are aware of this and they have notified CW, which is also direct proof for this practice,click for download

The indirect evidence however is very obvious and interesting.

When exporting goods, so called harmonized export codes are used, to register the goods and determine the taxes to be payed.

For most shipments CW used code 8207.30 (Tools for pressing, stamping or punching)

For Hasco parts which were initially shipped to NL the number 8480.20 (Mould bases) was used

With these HS-codes some basic analysis can be done with info available on the web (customs will have more details to investigate):

I very good source where a lot of info can be found is www.oec.world

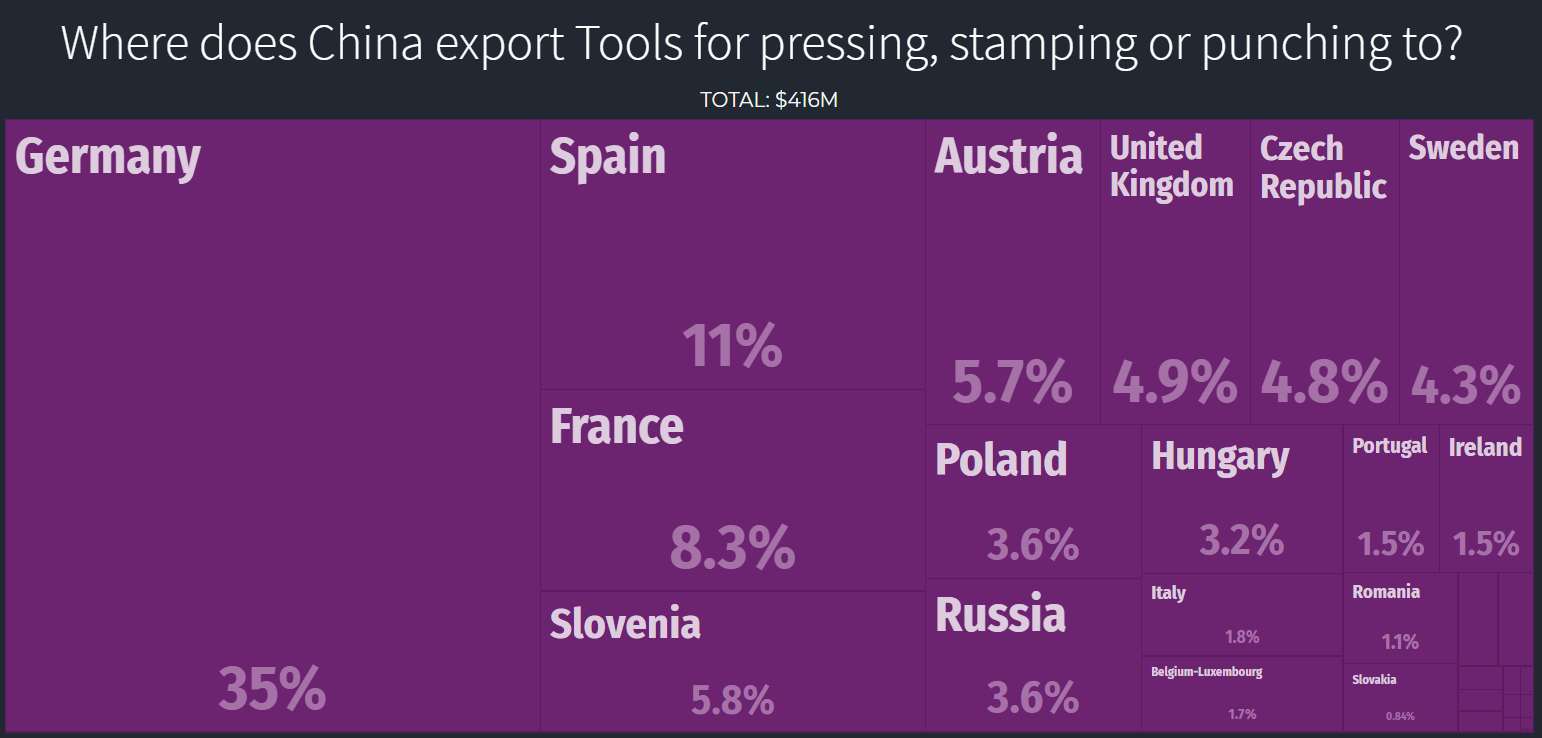

Here an example of the exports from China to Europe in 2017 for 8207.30

With the information from the mondial database and the sales data from CW some comparisons can be made:

| Total exports from China of HS 8207.30 from declared values |

Real sales values by Chen-Wey (see elsewhere on this website) |

||||

| Year | to Europe [$] | to Germany [$] | to Europe [$] | to Germany [$] | |

| 2004 | 4.5M | 1.2M | |||

| 2005 | 8.3M | 2.4M | |||

| 2006 | 2.5M | 2.5M | 1.2M | 0.4M | |

| 2007 | 30.0M | 12.5M | 2.8M | 1.4M | |

| 2008 | 42.2M | 11.7M | 3.4M | 2.1M | |

| 2009 | 40.6M | 17.9M | 2.2M | 1.3M | |

| 2010 | 59.2M | 22.4M | 5.5M | 2.9M | |

| 2011 | 68.2M | 19.2M | |||

| 2012 | 121 M | 34.2M | our data reaches until 2010 | ||

| 2013 | 227 M | 38.8M | |||

| 2014 | 262 M | 44.6M | advise to customs: compare these values | ||

| 2015 | 271 M | 73.1M | invoiced by CW with declared values | ||

| 2016 | 261 M | 82.5M | |||

| 2017 | 416 M | 146 M | |||

The left part of the table contains declared values, used to register the imports, but also the import tax.

At the right side the real sales values based on actual invoices that CW has sent to clients.

Conclusions/observations

- It seems that for most years the value shipped by CW is in the range of 10% of the total value registered at the customs.

This would mean that CW is responsible for 10% of all exports of 8207.30

This is highly unlikely since there are quite some companies in this field, see for example the number of exhibitors at Blechexpo. It will need some more research since it could mean that the declared values are too low or that other suppliers use other numbers.

- In 2006 the value exported by CW to Germany would be half of all that was exported, which is strange for 2 reasons:

< >< >< >< >* other years the portion of CW is around 10% and suddenly 50%?

< >< >< >< >* Also is it highly doubtful that 1 company would be responsible for 50% of the total export from a country like China

- Another observation is that the export to Europe increased by a factor 100! from 2004 to 2017, while the total trade of all goods registered only increased by a factor 3. To find the cause for this would be interesting, since it could be that less fraude by devaluation takes place, that other articles are shipped with this code or that this business really grew by a factor 100

Based on these numbers it is most likely that many declared values are too low, not only from CW but also from other suppliers. But as long as the real values are lower than the declared values these are only assumptions.

EVIDENCE of FRAUD

In case the real values exported by CW would be higher than the total of all declared valueas of all suppliers together fraud can be proven.

It would prove that CW is manipulating invoices

but it is also highly likely that devaluation is done by other suppliers as well since it is highly unlikely that CW can be responsible for all exports.

We have identified the following cases proving fraud:

| Export of HS 8207.30 to Belgium | Export of HS 8480.20 to Netherlands | ||||||

| Year | Value declared by all suppliers [$] | Value invoiced by Chen-Wey [$] |

Value declared by all suppliers [$] | Value invoiced by Chen-Wey [$] |

|||

| 2006 | 199 K | 66.3K | 0 | ||||

| 2007 | 194 K | 232 K | |||||

| 2008 | 1.31M | 103 K | 328 K | ||||

| 2009 | 141 K | 40.6K | 171 K | ||||

| 2010 | 333 K | 41.3K | |||||

NOTE

This industry is very suitable for fraud by devaluation, since parts are hard to judge for their value (by customs) and they can have an extremely high value to weight ratio, meaning that even a package of 1kg could have a value of thousands of Euros. Typical raw materials are in the cost range of 20-60 €/kg, but the additional very precise processing up to micron precision will generate a lot of added value. In general we would estimate an average value of 100 €/kg for 8207.30 for suppliers of precision parts.

For the same supplier €/kg their shipments should have comparable ratio's. If the ratio's between shipments differ too much . (e.g. > factor 50) you can be assured that fraud takes place.

Companies on the client list are for example typical companies that purchase shipments with value/weight ratio's > 50 €/kg

This is a niche market that probably does not get too much attention but the damage by this fraud could be quite considerable.

DAMAGE

Assume CW was the only supplier for 8480.20 in NL in 2009 then they declared only 5,6% of their real sales (see table right above).

Based on experience this value the 5.6% seems quite conservative and expceted to be higher since CW was probably not the only exporter for 8480.20 in 2009.

If the conservative 5.6% would also be valid for 8207.30 in 2017 the total export in 2017 would not be 416M$ but: 7428M$

With CW having an estimated export of around 7M$ this would mean there would be around 1.000 companies of the same size would be operating in this field, (or more with less turnover) which could very well be based on exhibitors on several Fachmessen.

It also means that 7.000M$ is not decalred at custums, which means a damage of almost 200M$ per year to the European economy, since importrate for 8207.30 is 2.7%